As the 2026 tax season approaches, many Americans are searching for accurate and reliable information about the IRS tax refund 2026 guide and when they can expect their refunds. Tax refunds often play a significant role in household financial planning, helping cover expenses such as rent, healthcare, education, and debt payments. However, online rumors and social media claims about guaranteed refund dates have created confusion and unrealistic expectations.

Understanding how the IRS processes tax returns and issues refunds is essential for taxpayers. The refund process follows strict verification rules, and timing varies based on individual tax returns. Knowing the official procedures helps taxpayers plan their finances responsibly and avoid misinformation.

IRS Does Not Provide a Fixed Refund Schedule for All Taxpayers

One of the most important facts taxpayers should understand is that the IRS does not publish a fixed refund calendar with guaranteed payment dates for everyone. Refunds are issued only after tax returns are filed, accepted, and fully processed.

Each tax return is unique, and processing times can vary depending on the information provided, filing method, and verification requirements. Claims circulating online that promise exact refund dates for all taxpayers are not based on official IRS information.

Refund timing depends on when the IRS accepts the return and completes all required checks. Because each taxpayer’s situation differs, refund timelines cannot be identical for everyone.

How the IRS Processes Tax Returns Before Issuing Refunds

The IRS follows a detailed process to review tax returns before approving refunds. This process ensures accuracy and protects against fraud or incorrect payments.

After receiving a tax return, the IRS performs several verification checks, including:

- Confirming reported income and tax withholding

- Reviewing claimed deductions and tax credits

- Verifying taxpayer identity

- Checking for missing or incorrect information

Only after these checks are completed does the IRS approve and issue the refund. Even minor errors, such as incorrect figures or missing forms, can trigger manual review and delay processing.

This careful verification process helps ensure refunds are issued correctly and securely.

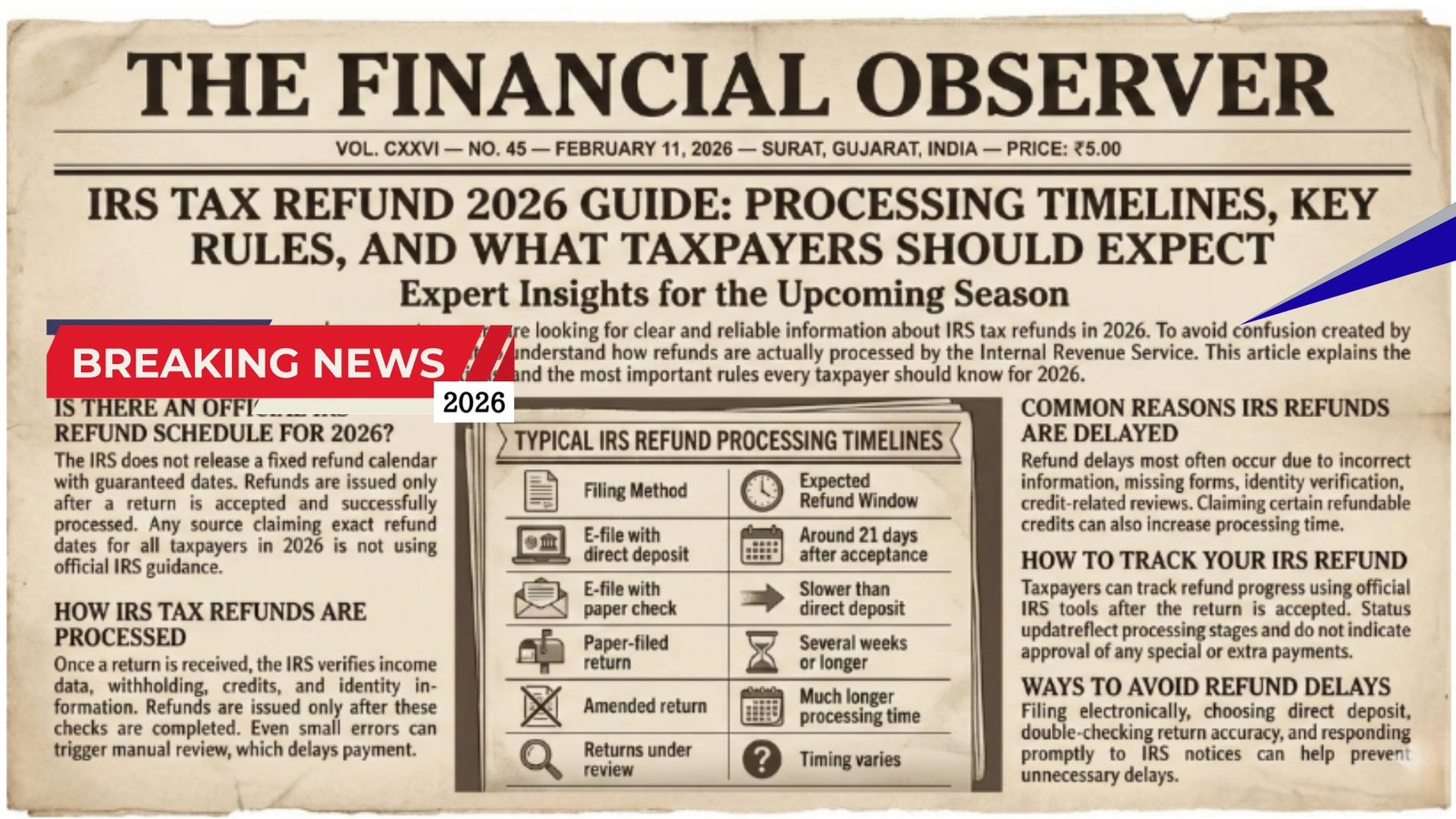

Estimated IRS Refund Processing Timeline 2026

Although the IRS does not guarantee exact refund dates, most refunds follow general processing timelines based on filing method and delivery option. The table below shows typical refund timelines.

| Filing Method | Refund Delivery Method | Estimated Processing Time |

|---|---|---|

| Electronic filing | Direct deposit | Usually within 21 days after IRS acceptance |

| Electronic filing | Paper check | Approximately 4 to 6 weeks |

| Paper return by mail | Paper check | Typically 6 to 8 weeks or longer |

Electronic filing combined with direct deposit remains the fastest way to receive refunds. Paper returns require manual handling, which increases processing time.

These timelines are estimates and may vary depending on individual circumstances.

Common Reasons for IRS Refund Delays in 2026

Refund delays are sometimes unavoidable and can occur for several reasons. The IRS must complete verification checks to ensure accuracy and prevent fraud.

Common causes of refund delays include:

- Errors or incorrect information on the tax return

- Missing required forms or incomplete details

- Mismatched income or identity information

- Identity verification requests

- Claims involving refundable tax credits

Returns that include refundable credits may take longer because additional verification rules apply. These safeguards help prevent incorrect payments and protect taxpayer funds.

Responding quickly to IRS requests can help reduce delays.

How Taxpayers Can Track Their IRS Refund Timeline 2026

Taxpayers can track their refund status using official IRS tools. These tools provide accurate updates and help taxpayers understand where their refund stands in the processing system.

The main IRS refund tracking tool shows three key status stages:

| Refund Status | Meaning |

|---|---|

| Return Received | IRS has received and started processing the return |

| Return Approved | Refund has been approved |

| Refund Sent | Refund has been issued and is on its way |

These updates help taxpayers know when their refund is being processed and when to expect payment.

Taxpayers should rely only on official IRS tools for accurate information and avoid relying on unofficial sources.

Steps Taxpayers Can Take to Receive Refunds Faster

Taxpayers can take specific steps to improve refund processing speed and reduce the risk of delays. These steps ensure accurate filing and faster payment delivery.

Recommended steps include:

- Filing tax returns electronically instead of mailing paper returns

- Choosing direct deposit instead of paper checks

- Reviewing all information carefully before submitting

- Providing complete and accurate documentation

- Responding quickly to any IRS notices or requests

Electronic filing allows faster processing, while direct deposit ensures quicker payment delivery.

Taking these steps helps reduce errors and improves refund efficiency.

Why IRS Verification and Security Checks Are Important

The IRS uses verification checks to protect taxpayers and ensure accurate refund processing. These checks help prevent identity theft, fraud, and incorrect payments.

Security measures may involve identity verification or reviewing unusual claims. While these checks may extend processing time, they help maintain the integrity of the tax system.

These safeguards ensure refunds are issued correctly and to the right individuals.

What Taxpayers Should Expect From IRS Refunds in 2026

The IRS refund timeline 2026 will follow standard procedures based on individual tax returns and verification requirements. Many taxpayers who file electronically and use direct deposit receive refunds within about three weeks.

However, delays may occur if verification is required or errors are found. Understanding the refund process helps taxpayers avoid unrealistic expectations and plan their finances responsibly.

Taxpayers should rely on official IRS tools and verified information for updates on refund status.

Conclusion: IRS Tax Refund 2026 Guide Helps Taxpayers Understand Processing and Timeline

The IRS tax refund 2026 guide explains how the IRS processes tax returns and issues refunds based on individual filings. There is no fixed refund schedule for all taxpayers, and timing depends on verification checks, filing method, and accuracy.

Most taxpayers who file electronically and choose direct deposit receive refunds within about 21 days. However, delays may occur due to verification requirements or errors. Tracking refunds using official IRS tools provides accurate updates and helps taxpayers stay informed.

Understanding the IRS refund timeline 2026 allows taxpayers to prepare financially and avoid confusion caused by misinformation. Filing accurate returns and choosing electronic filing with direct deposit remain the best ways to receive refunds quickly and securely.