Talk about a possible $2,000 federal direct deposit February 2026 has been spreading quickly across the United States. Many social media posts and online discussions claim that everyone may receive a $2,000 payment during February. These claims have created hope for families dealing with high rent, grocery prices, healthcare costs, and utility bills. At the same time, the lack of official confirmation has caused confusion about whether this payment is real or still under discussion.

Unlike the stimulus payments issued during earlier emergency periods, this proposed federal deposit has not been officially approved. Understanding the difference between confirmed government programs and ongoing discussions is important for households planning their finances.

Why the $2,000 Federal Direct Deposit Is Being Discussed in 2026

The renewed attention around the $2,000 payment is closely tied to continued financial pressure on many American households. Even though inflation has slowed compared to previous years, everyday expenses such as housing, groceries, insurance, and energy bills remain high. Many families continue to face challenges balancing income and expenses.

Because of these conditions, some lawmakers and advocacy groups have discussed the idea of a one-time direct payment. Supporters believe direct deposits can provide fast financial support and help households manage short-term financial needs. These payments are often considered effective because they can be delivered quickly through existing government systems.

However, discussions alone do not guarantee approval. Many proposals are introduced during policy debates but do not move forward into law.

Political and Economic Factors Affecting the Proposal

The discussion of a $2,000 federal direct deposit February 2026 is also connected to political and economic priorities. As public concern about the cost of living continues, financial relief proposals often receive attention from lawmakers and the public.

Direct deposit payments are easy to understand and can quickly reach millions of people. Because of this, they are often viewed as a straightforward way to provide temporary relief. However, there is disagreement among policymakers about whether one-time payments address long-term economic challenges.

This disagreement has kept the proposal in discussion without any final approval. Until a bill is passed and signed into law, no payment can be officially issued.

Current Official Status: No Approved $2,000 Federal Direct Deposit

As of February 2026, there is no official approval for a nationwide $2,000 federal direct deposit. Congress has not passed any legislation authorizing such a payment. Without approved legislation, government agencies such as the Treasury Department and Internal Revenue Service cannot release funds.

At this stage, the payment remains part of policy discussions and proposals. Many ideas are discussed during budget planning, but only approved legislation leads to actual payments.

The absence of official approval means no confirmed payment schedule currently exists.

Why February 2026 Is Frequently Mentioned in Payment Discussions

February 2026 is often mentioned because it aligns with the federal tax season, when millions of financial transactions are already being processed. During this time, the IRS handles tax refunds and benefit payments using established systems.

From an administrative perspective, issuing payments during tax season may appear practical. However, being a convenient time does not mean a payment has been approved.

Approval requires completion of the full legislative process, including congressional approval and presidential authorization.

Without this process, no federal payment can be issued.

Possible Eligibility Criteria If the Payment Is Approved

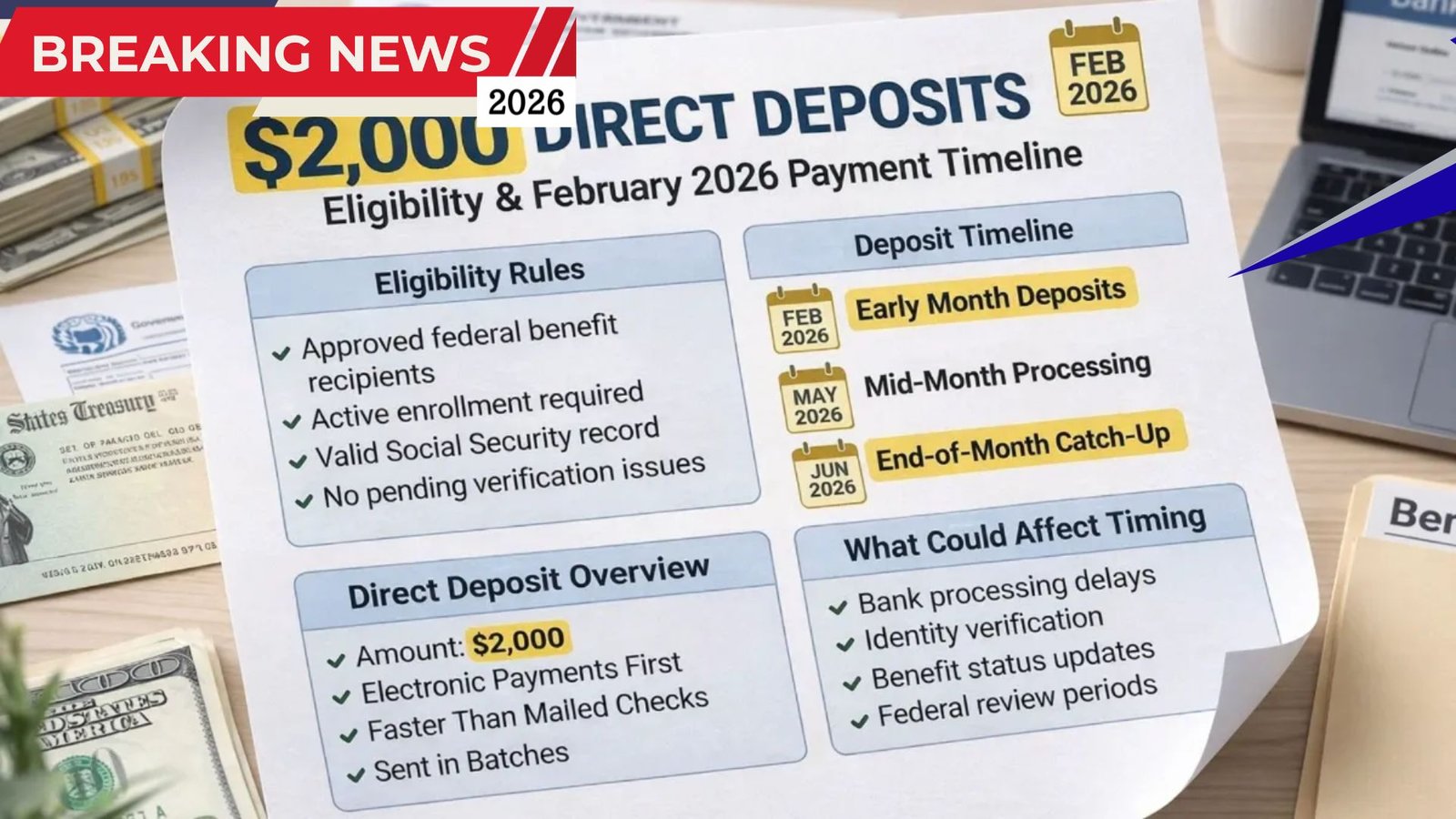

Although phrases like “$2,000 for everyone” are widely used online, actual federal payment programs typically include eligibility conditions. If approved, eligibility would likely depend on factors such as income, residency, and tax filing status.

Common eligibility factors in similar programs include:

| Eligibility Factor | Possible Requirement |

|---|---|

| Residency | U.S. citizens or qualifying legal residents |

| Social Security Number | Valid SSN required |

| Income Level | Lower and middle-income households prioritized |

| Tax Filing Status | Based on recent tax returns |

| Benefit Recipients | Social Security, SSI, and SSDI recipients may qualify |

Higher-income households might receive reduced payments or no payment at all.

Exact eligibility rules would only be confirmed after official legislation is passed.

How Payments Would Likely Be Delivered If Approved

If the federal government approves the payment, it would likely use existing payment systems to distribute funds. Direct deposit would be the fastest and most efficient delivery method.

Payments would likely be sent through:

- Direct deposit to bank accounts on file

- Paper checks mailed to eligible recipients

- Prepaid debit cards in some cases

Direct deposit is generally faster because it does not require mailing or manual processing.

Ensuring accurate bank account and personal information helps prevent delays.

Why Social Media Claims Have Created Confusion

Social media plays a major role in spreading payment claims quickly. Many posts use headlines suggesting guaranteed deposits, even when no official approval exists. These claims can lead to misunderstanding and false expectations.

Government payments require legal approval before distribution. Without this approval, no agency can legally issue funds.

Relying on official government announcements remains the safest way to confirm payment information.

What Americans Should Do While Waiting for Official Confirmation

Until official announcements are made, households should avoid making financial plans based on unapproved payments. Social media rumors and unofficial claims should be viewed carefully.

The safest steps include:

- Filing taxes on time

- Keeping bank and personal information updated

- Monitoring official government websites

- Avoiding scams requesting personal details

If any new federal payment is approved, it will be announced through official government channels.

Conclusion: $2,000 Federal Direct Deposit February 2026 Remains Unapproved

The discussion around the $2,000 federal direct deposit February 2026 reflects ongoing financial challenges faced by many households. While the proposal continues to receive attention, no official legislation has been passed to authorize the payment.

Without congressional approval and presidential authorization, federal agencies cannot release funds. February 2026 remains a theoretical timeline rather than a confirmed payment date.

Understanding the difference between discussions and approved programs helps households avoid confusion and make informed financial decisions. Official government announcements remain the only reliable source of payment confirmation.